Oil at 30$…? – should Clean Energy panic or celebrate – A quick look at the possible direct correlation between oil prices and Clean Energy industry growth – possible short term pitfalls and scenarios.

Oil at 30$…? – should Clean Energy panic or celebrate – A quick look at the possible direct correlation between oil prices and Clean Energy industry growth – possible short term pitfalls and scenarios.

Dealing with pounding and controversial news

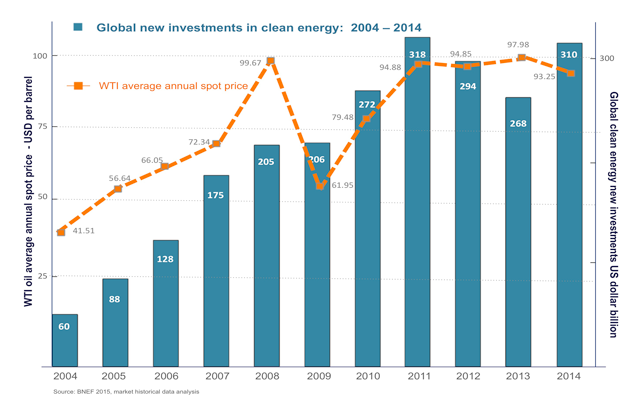

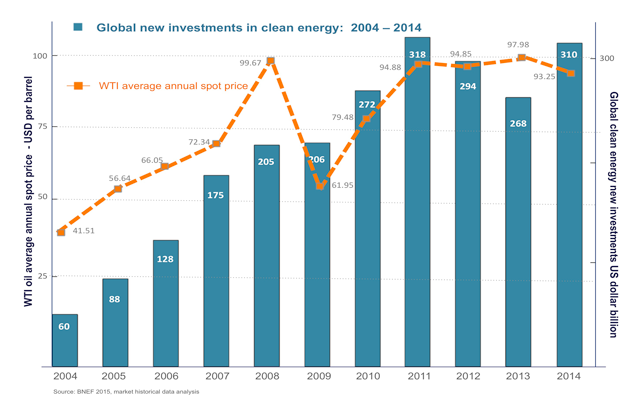

Most of the business news populating virtually any single communication channel in these days are, more than ever, dedicated to predicting where and when crude oil could find a bottom, some of them even forecasting a “catastrophic” price of 30$ per barrel. According to some experts or opinion leaders, this level, once reached, apparently quite soon, should mark the end of the Clean Energy industry. Let’s take a closer look at that.

The geopolitical oil arm wrestle – who will succumb first

The geopolitical oil arm wrestle – who will succumb first

I’m not arguing that the crude price could even fall to such an anomalous level, though some analysts expect a rapid recovery to $100 barrel, because this is the price required in order to justify ongoing exploration for new resources. The well known ongoing arm wrestling triggered by US ambition for energy independence, a legitimate strategy leveraging on shale oil, and OPEC resistance, whose recent decision to keep production levels as nothing had happened in most of the developed economies caught in recession for the last 7 years, is putting the world in fibrillation. Read more

7 Top reasons why Renewable Energy Transactions fail – Investors seek both steady return on capital and value preservation.

7 Top reasons why Renewable Energy Transactions fail – Investors seek both steady return on capital and value preservation.

1. Lack of stability in regulatory environment

and more broadly in governmental energy policies, induce uncertainty in future cash flows predictability. Investors seek both steady returns on capitals and value preservation. A stable regulatory framework is at the core of the investment decision

2. Badly structured documentation pack

including project description, NDA/LOI, project Teaser, unstable PPA, undefined or unrealistic business/financial models, inadequacy or instability of the data rooms, too generic SPAs, poorly defined commissioning and testing process of power plants Read more

EU leaders agree to cut greenhouse gas emissions by 40% by 2030.

EU leaders agree to cut greenhouse gas emissions by 40% by 2030.

A new agreement on reducing greenhouse emissions and energy use across the EU was reached last week. The EU has agreed a broad climate change pact obliging the EU as a whole to cut greenhouse gases by at least 40% by 2030. The absence of national targets can be viewed in two ways: first it lets individual countries to decide what is best for them, second it allows some internal trading on emissions for those countries that are more locked into a higher carbon path going forward. Two other targets were agreed – a target for a 27% renewable energy market share and increase in energy efficiency improvement of 27%. The former would be binding only on the EU as a whole. The latter would be optional, although it could be raised to 30% by a review in 2020. The anticipated 40% greenhouse gas cut by 2030 would be measured against benchmark 1990 levels, see ec.europa.eu/clima/policies/ets/reform/documentation_en.htm. The EU would like to think this puts pressure on the USA and China to respond favorably in joining Kyoto framework adopters.

2030 Market Outlook – By Bloomberg.

2030 Market Outlook – By Bloomberg.

The rapid growth of Renewables across the world is set to to keep increasing. According to the very latest forecast issued by Bloomberg New Energy Finance’s (BNEF) 2030 Market Outlook, Renewable energy could represent up to 65% of the $7.7 trillion in new power plant investments and 60% of all new capacity additions expected over the next 15 years. The rapid fall in solar photovoltaic (PV) costs will power renewables’ rise. Wind energy will also contribute to the boom – combined with solar, the two technologies will grow their share of global generation from 3% in 2013 to 16% in 2030.