![]() Oil at 30$…? – should Clean Energy panic or celebrate – A quick look at the possible direct correlation between oil prices and Clean Energy industry growth – possible short term pitfalls and scenarios.

Oil at 30$…? – should Clean Energy panic or celebrate – A quick look at the possible direct correlation between oil prices and Clean Energy industry growth – possible short term pitfalls and scenarios.

Dealing with pounding and controversial news

Most of the business news populating virtually any single communication channel in these days are, more than ever, dedicated to predicting where and when crude oil could find a bottom, some of them even forecasting a “catastrophic” price of 30$ per barrel. According to some experts or opinion leaders, this level, once reached, apparently quite soon, should mark the end of the Clean Energy industry. Let’s take a closer look at that.

The geopolitical oil arm wrestle – who will succumb first

The geopolitical oil arm wrestle – who will succumb first

I’m not arguing that the crude price could even fall to such an anomalous level, though some analysts expect a rapid recovery to $100 barrel, because this is the price required in order to justify ongoing exploration for new resources. The well known ongoing arm wrestling triggered by US ambition for energy independence, a legitimate strategy leveraging on shale oil, and OPEC resistance, whose recent decision to keep production levels as nothing had happened in most of the developed economies caught in recession for the last 7 years, is putting the world in fibrillation. The fight is on market share and control. Oil prices are in free fall but OPEC said they’ll let it go until a market adjusted “natural floor” is found. They do not seem to worry on the huge losses on earnings/barrel that soon will impact on their balance sheets. We know that $40 a barrel is the top of the industry’s operating cost curve, i.e. the price at which individual wells break even after they’ve been drilled and are producing and below which operators shut in existing wells. Sure this battle is inducing heavy consequences on global markets and perceived as a fearsome threat for the global growth, nevertheless one should be very cautious before to announce the funeral of Clean Energies and related investments.

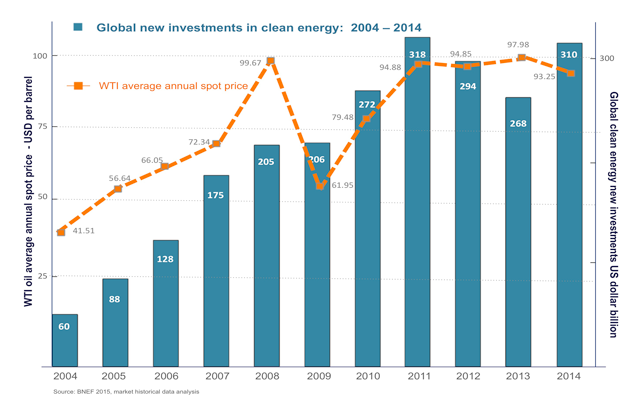

Why this – let’s see what historical data and global scenarios tell us

First of all, the very last year, despite the collapse of oil prices, new investments in Clean Energy, according to BNEF 2015 report, regained their pick by reaching 310 $bln, close to record high. This 16% increase in new investments, when the world is facing one of the most and violent financial crises since ever, demonstrates the resilience of the sector in the face of tumbling oil prices and of unfavorable economic context. Secondly, most of the western countries are progressively abandoning nuclear power sources opening up the doors for a consistent robust demand aimed at reaching a sound Clean Energy/traditional energy balance. Thirdly, this growing trend is set to continue as technology around Clean Energy becomes more affordable also considering the increasing role that Clean Energy is playing in emerging markets, that are shifting from pure cost effective suppliers to massive adopter of their own technologies within their internal (huge) markets. Moreover, during the first year of the financial crisis (2008-2009), the crude price dropped by approx. 40% reaching 61.97$ a barrel, whilst the total investments in Clean Tech remained steady at 206 $bln. Sure a reduced growth, but not a crisis.

The survival of Clean Energy – are fundamentals still intact?

Clean Energy industry is now out of its infancy stage and most of the countries that joined Kyoto treaty have dramatically reduced, if not entirely abolished, public incentives and subsidies to clean energy producers. In this context, technology prices have fallen as much as 75% in the last 5-6 years and continue to decrease thanks to the streamlining of production process, scale economies with larger size plants and more competitive O&M agreements as investors want predictable ROIs. The real enemy to fight in this context is the governmental and political instability, as in much of the Western world, the very weak economic climate since 2008 has also impacted supporting schemes and progressively eroded the very high – sometimes shamefully high – margins for all players involved. But the industry has proven to quickly adapt and thanks to better focused investments in R&D, in energy storage systems, in nanotechnologies and in lean production processes, it’s continuously boosting the efficiency of key components, lowering prices for turnkey solutions and, as expected, accelerating the grid parity goal achievement. As an example, last week in UAE a PV park of 100 MW, part of a bigger volume initiative, just went on electricity pricing auction mechanisms and got the planet’s lowest prices for solar energy with 5.4 US cents per KWh for 25 years. The price of natural gas – which generates 99 per cent of the UAE’s electricity – stands at 9 cents. This is the world’s cheapest price for solar energy, but still economically viable in this region.

No moving agendas

Climate change is very high on the agenda for most governments and Clean Energy is at the forefront of the solutions proposed to combat the global warming which is far from being solved. I’m persuaded that the rationale behind the strong development of Clean Energy is intact in the long run and its further development cannot be dependent on the fluctuations – although violent and speculative – of oil prices observed in the very recent periods but rather on the increasing awareness of responsible citizens more and more embracing the need for a better and cleaner world to be delivered to our children.

Fundamentals in favor of Clean Energy are clearly intact and all the above should further reassure the investor community and all parties involved.

What next for Clean Energy – mid term outlook for an adaptive industry

This mature industry with approx. 1,600 gigawatts (GW) in 2014 of installed capacity is set to reach 3,203 GW in 2025, according to the last report of Frost & Sullivan, at an average annual growth rate of 5.7 per cent. Robust investments pipeline, strong installed base, industry maturity, better geographic distribution of the assets are key drivers for a steady growth in M&A market as well. So, there is certainly no reason to panic nor to celebrate for oil roller coaster. We just have to remain vigilant and cleverly focused to technical shifts, markets dynamics, moving policy landscape and external developments and quickly innovate and adapt to these fast-evolving scenarios. The potential is still enormous and, in most of the cases, unexploited. Clean Energy has still long life ahead and its outlook is great!

Giuseppe Stinca – Partner

At-Venture Business Strategies LLC

Comments are closed.